Capital expenditure at Whitby's Woodsmith Mine is to be curtailed over the next two years as Anglo American refocuses it's priorities

Anglo American says that following a review of it's assets it is simplifying it's portfolio in the Copper, Iron Ore and crop Nutrients sectors as it looks to lower it's costs by $1.7bn, unlock significant value from its portfolio and "accelerate the delivery of consistently stronger shareholder returns".

It will sell off some parts of it's business including the De Beers Diamond business and it's Platinum and Coal operations.

The company says the Woodsmith Mine remains integral to the companies growth but says that in the short term it will "slow down" the development of the project reducing it's capital investment to $200m next year and nothing the year after that, although the site will continue to have an operational budget.

Chief Executive - Duncan Wanblad - says the Woodsmith Mine will remain integral to the companies future.

Mr Wanblad said:

"Our decision to focus Anglo American’s portfolio in our world-class resource asset base in copper and premium iron ore – while retaining our crop nutrients optionality at Woodsmith – marks a major new phase in executing our strategy.

We expect that a radically simpler business will deliver sustainable incremental value creation through a step change in operational performance and cost reduction."

"“These actions represent the most radical changes to Anglo American in decades. I believe these are the right decisions to position Anglo American to capitalise on the outstanding resource endowment opportunities within our portfolio today. "

The company says it will work out the full details of this slow down over the coming weeks.

Tom McCulley, CEO of Anglo American’s Crop Nutrients business, said:

“Anglo American has again stated that Woodsmith is central to its growth plans as a Tier 1 resource -entirely aligned with the demand trends of decarbonisation and food security.

“We have been progressing the project on time and on budget but have decided to slow development in the near term. I’m incredibly proud of the progress we have made so far, the positive impact on the local area and the partnerships we have built in our local communities, which we will continue to engage positively with.

“Anglo American continues to recognise Woodsmith’s unique resource and long-term value potential and will complete critical technical studies in 2025 to then enable syndication for value with one or more strategic partners.

“We need to work out the full details of this slow down over the coming weeks as we reduce activity while retaining optionality for the long term.

“A key aspect of this will be to continue adhering to our planning obligations with the North York Moors National Park Authority and Redcar and Cleveland Borough Council.

“I know that this announcement will create uncertainty, but we will keep our workforce and community stakeholders updated as we work through the detail of what this means for everyone.”

The restructuring of the company comes just days after a renewed merger proposal was submitted to the company by rival firm BHP Group. Anglo American's board rejected the proposal saying it undervalued the company and it's future prospects.

Stuart Chambers, Chairman of Anglo American, commented:

“The latest proposal from BHP again fails to recognise the value inherent in Anglo American.

Anglo American shareholders are well positioned to benefit from increasing demand from future enabling products while the increasing capital intensity to bring greenfield supply online makes proven assets with world class resource endowments ever more attractive.

The Anglo American team is focused on delivering against its strategic priorities of operational excellence, portfolio simplification and growth and is set to accelerate delivery in order to unlock this inherent value.

The BHP proposal also continues to have a highly unattractive structure. This leaves Anglo American, its shareholders and stakeholders disproportionately at risk from the substantial uncertainty and execution risk created by the proposed inter-conditional execution of two demergers and a takeover.”

Shellfish Report Reveals 'Catastrophic Impact' on Yorkshire Coast Fishing Communities

Shellfish Report Reveals 'Catastrophic Impact' on Yorkshire Coast Fishing Communities

Tory Council Leader Hails Cross Party Work in East Riding

Tory Council Leader Hails Cross Party Work in East Riding

Bridlington Man Aims To Deliver Defib

Bridlington Man Aims To Deliver Defib

North Yorkshire Mayor Announces £4 Million High Street Boost

North Yorkshire Mayor Announces £4 Million High Street Boost

Whitby Town Edged Out By National Leaguers

Whitby Town Edged Out By National Leaguers

Brid Beat Barton After Second Half Treble

Brid Beat Barton After Second Half Treble

RSPCA Reveal Abandoned Puppies in East Riding

RSPCA Reveal Abandoned Puppies in East Riding

Bridmas Festive Fun Returns to Bridlington This August

Bridmas Festive Fun Returns to Bridlington This August

Yorkshire Coast Barratt Homes Site Managers Named as Best in the Country

Yorkshire Coast Barratt Homes Site Managers Named as Best in the Country

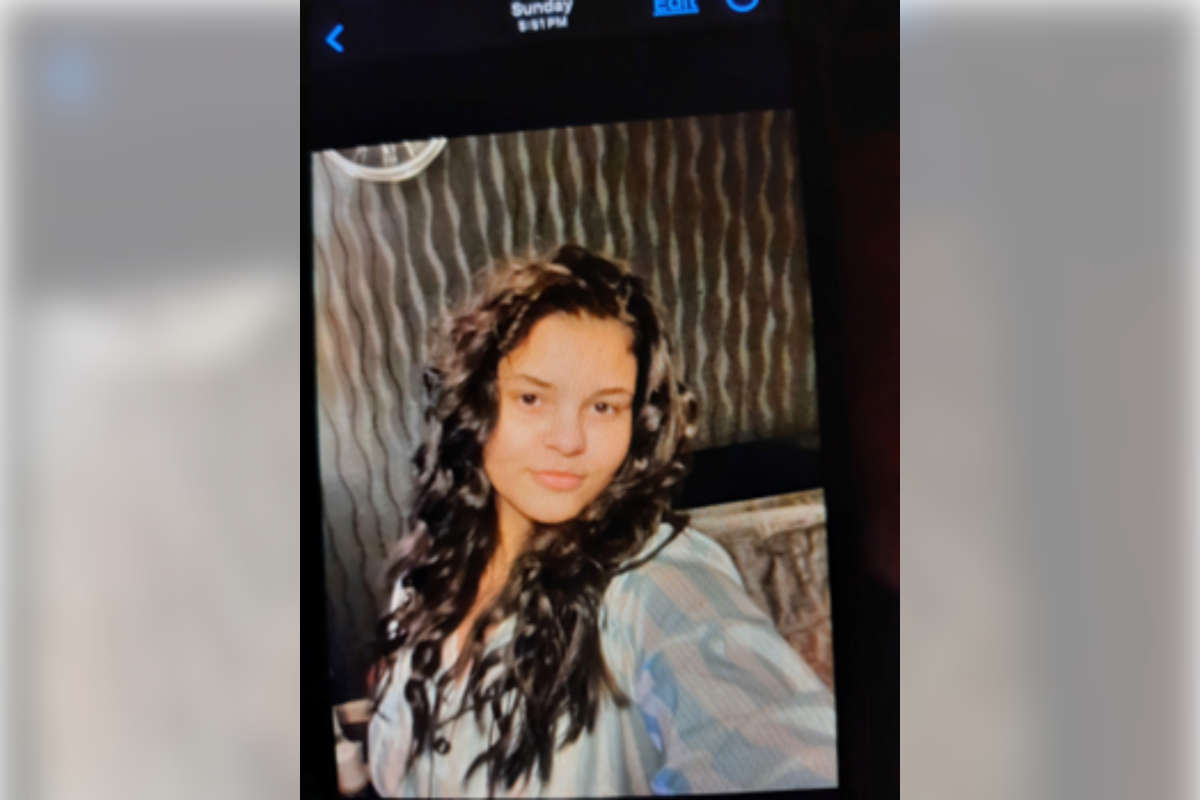

Scarborough Police Searching For Missing Teenager

Scarborough Police Searching For Missing Teenager

Concern About ‘Lack of Transparency’ in A64 Speed Camera Trial

Concern About ‘Lack of Transparency’ in A64 Speed Camera Trial

Scarborough Extreme Showcase Day

Scarborough Extreme Showcase Day

Comments

Add a comment