The rate of inflation has eased to 3.6%, according to official figures that make for better reading for the economy and chancellor ahead of the budget.

The Office for National Statistics (ONS) said the slowdown in the consumer prices index (CPI) measure, from the annual 3.8% rate recorded the previous month, was largely down to weaker housing effects, especially from energy bills.

ONS chief economist Grant Fitzner said: "Inflation eased in October, driven mainly by gas and electricity prices, which increased less than this time last year following changes in the Ofgem energy price cap.

Money latest: Delivery not arrived? Here's what you can do

"The costs of hotels was also a downward driver, with prices falling this month. These were only partially offset by rising food prices, following the dip seen in September.

"The annual cost of raw materials for businesses continued to increase, while factory gate prices also rose."

The final part of that statement will be seen as a risk to expectations from economists that the peak pace for price increases is now behind the UK economy after a spike this year that has caused concern among interest rate-setters at the Bank of England.

October's data marked the first decline for the inflation rate since March.

It has been widely believed that the figure will ease gradually in the months ahead, helping to cushion household spending power from a slowdown in wage growth.

But key risks include shocks within the global economy and the impact of potential measures in the budget next week.

The chancellor's first budget was blamed by business groups and economists for helping push up costs since April.

Then, firms passed on hikes to employer national insurance contributions and minimum pay levels imposed by Rachel Reeves.

That has been reflected in many supermarket prices, for example, as they are among the biggest employers in the country. The ONS data showed that food inflation rose from 4.5% to 4.9%.

Other factors have contributed too such as high global demand for chicken and shrinking UK cattle herds pushing up beef costs.

Poor cocoa and coffee harvests have resulted in prices spiking too this year, with chocolate standing at record levels this summer.

While food has been a main contributor to inflation, so too has energy, though bills have stabilised this year thanks largely to healthy global supplies of natural gas.

Petrol and diesel costs could become more of a problem for inflation, however.

The AA has blamed global factors for UK fuel prices nearing their highest level for seven months.

The motoring group said that but for the 5p cut in fuel duty under the last Conservative government, pump prices would have returned to pre-COVID levels.

There have been rumours that Ms Reeves could remove that reduction next Wednesday.

She said of the ONS figures: "This fall in inflation is good news for households and businesses across the country, but I’m determined to do more to bring prices down.

"That’s why at the budget next week I will take the fair choices to deliver on the public’s priorities to cut NHS waiting lists, cut national debt and cut the cost of living."

When asked if she recognised a contribution to rising inflation from her first budget, she responded: "Food prices fell last month and they have risen this month.

"But I do recognise that there's more that we need to do to tackle the cost of living challenges. And that's why one of the three priorities in my budget next week is to tackle the cost of living, as well as to cut NHS waiting lists and cut government debt."

The Bank of England's most recent forecasts see its 2% inflation target not being met until the early part of 2027.

Stubborn inflation in the UK has threatened the pace of interest rate cuts but policymakers are expected, by financial markets at least, to agree a further quarter point reduction next month on the back of weakness in economic growth and the labour market.

Official figures last week showed the UK's unemployment rate rising to 5% from 4.8% and the pace of wage growth continuing its gradual decline.

Economic output during the third quarter of the year also slowed further to stand at just 0.1%.

Read more:

What taxes could go up now?

Is Starmer 'in office but not in power'?

Budget income tax U-turn. What happened?

The Bank's rate-setting committee voted 5-4 earlier this month to maintain Bank rate at 4%.

That decision allowed for more data to come in - such as the employment and growth numbers - and, crucially, for the budget to have taken place, ahead of its next meeting.

(c) Sky News 2025: Inflation slows to 3.6%, but food costs shoot upwards

Former Met Police officer David Carrick found guilty of more sexual offences

Former Met Police officer David Carrick found guilty of more sexual offences

UK 'moving at glacial pace' on national plan for defending foreign attack, say MPs

UK 'moving at glacial pace' on national plan for defending foreign attack, say MPs

Man charged with further offences following Huntingdon train stabbing

Man charged with further offences following Huntingdon train stabbing

Wintry blast could be a dry run for a cold December, forecasts suggest

Wintry blast could be a dry run for a cold December, forecasts suggest

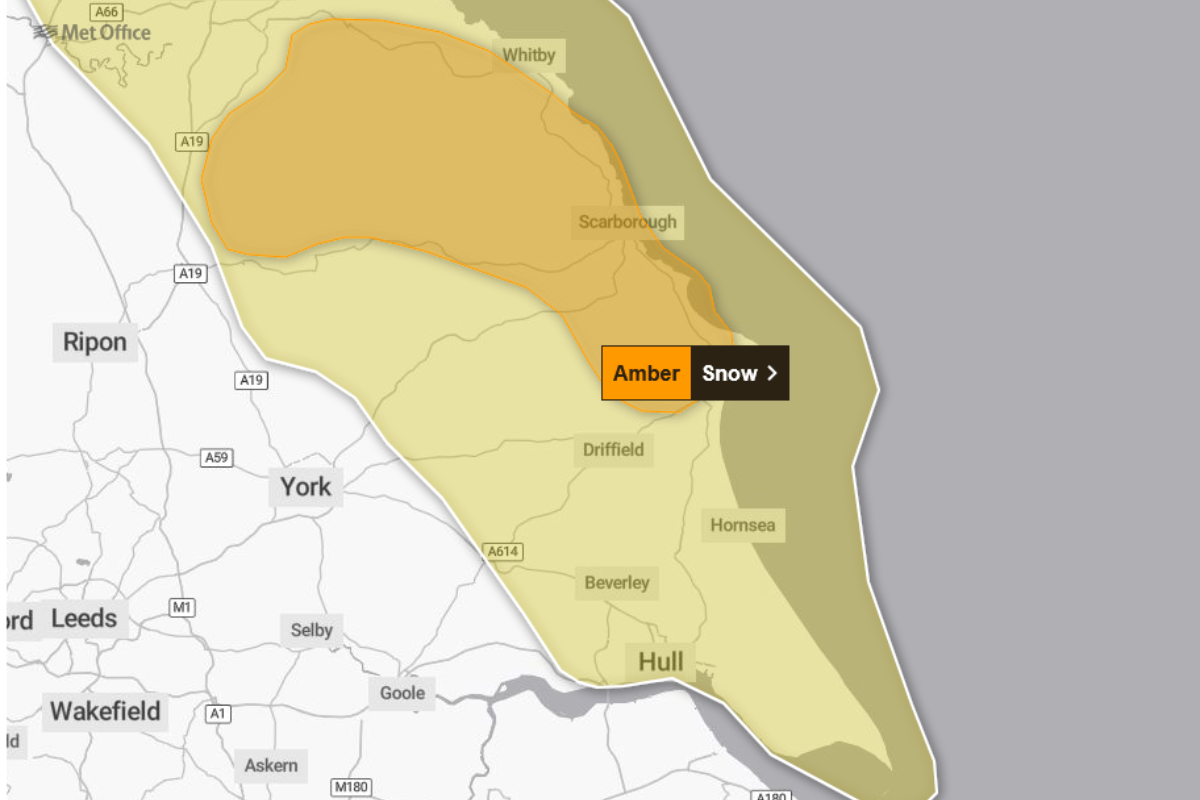

UK weather: Amber and new yellow Met Office warnings in place as parts of UK hit by heavy snow

UK weather: Amber and new yellow Met Office warnings in place as parts of UK hit by heavy snow

Ultra-processed foods leading cause of 'chronic disease pandemic', say experts

Ultra-processed foods leading cause of 'chronic disease pandemic', say experts

Best and worst parcel delivery companies revealed

Best and worst parcel delivery companies revealed

What is the mysterious Yantar 'spy ship' - and is it mapping Britain's undersea cables?

What is the mysterious Yantar 'spy ship' - and is it mapping Britain's undersea cables?

What is each supermarket's policy if your delivery is late?

What is each supermarket's policy if your delivery is late?