Mining group Anglo American has turned down a £31bn takeover offer from its Australian rival BHP.

Anglo American's board said the proposed deal "significantly undervalues" the company and "is highly unattractive for its shareholders."

The merger would have been one of the biggest deals the sector has seen in recent years.

The Proposal comprised an all-share offer for Anglo American by BHP, with a requirement for Anglo American to complete two separate demergers of its entire shareholdings in Anglo American Platinum Limited and Kumba Iron Ore Limited to Anglo American shareholders. The all-share offer and required demergers would be inter-conditional.

The Board says it has considered the Proposal with its advisers and concluded that the Proposal significantly undervalues Anglo American and its future prospects.

In addition, the Proposal contemplates a structure which the Board believes is highly unattractive for Anglo American’s shareholders, given the uncertainty and complexity inherent in the Proposal, and significant execution risks.

The Board has therefore unanimously rejected the Proposal.

Stuart Chambers, Chairman of Anglo American, commented:

"Anglo American is well positioned to create significant value from its portfolio of high quality assets that are well aligned with the energy transition and other major demand trends. With copper representing 30% of Anglo American’s total production, and with the benefit of well-sequenced and value-accretive growth options in copper and other structurally attractive products, the Board believes that Anglo American’s shareholders stand to benefit from what we expect to be significant value appreciation as the full impact of those trends materialises.

“The BHP proposal is opportunistic and fails to value Anglo American’s prospects, while significantly diluting the relative value upside participation of Anglo American’s shareholders relative to BHP’s shareholders. The proposed structure is also highly unattractive, creating substantial uncertainty and execution risk borne almost entirely by Anglo American, its shareholders and its other stakeholders. Anglo American has defined clear strategic priorities – of operational excellence, portfolio, and growth – to deliver full value potential and is entirely focused on that delivery.”

Anglo American shareholders are being advised by the company to take no action in relation to the possible offer.

The company says:

"A further announcement will be made as and when appropriate. There can be no certainty that any firm offer will be made.

Under Rule 2.6(a) of the Takeover Code, BHP must by not later than 5.00 p.m. on 22 May 2024, either announce a firm intention to make an offer for Anglo American in accordance with Rule 2.7 of the Takeover Code or announce that it does not intend to make an offer, in which case the announcement will be treated as a statement to which Rule 2.8 of the Takeover Code applies. This deadline will only be extended with the consent of the Takeover Panel in accordance with Rule 2.6(c) of the Takeover Code."

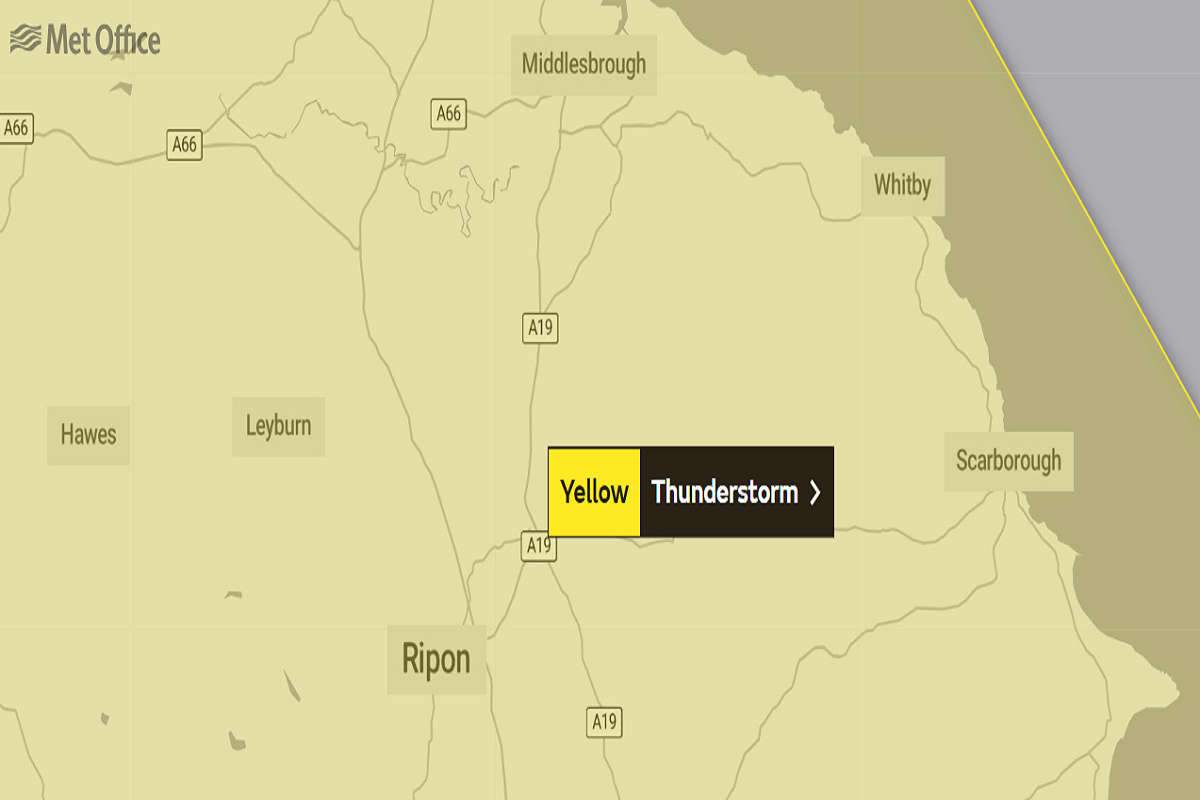

Met Office Thunder Warning for Yorkshire Coast

Met Office Thunder Warning for Yorkshire Coast

Four Drug Arrests in Sleepy East Riding Village

Four Drug Arrests in Sleepy East Riding Village

Concern Over Yorkshire Coast Hospital Travelling Distances

Concern Over Yorkshire Coast Hospital Travelling Distances

Scarborough Showpiece Finishes in Style on Bank Holiday Monday

Scarborough Showpiece Finishes in Style on Bank Holiday Monday

Fears Over North Yorkshire School Transport Rise

Fears Over North Yorkshire School Transport Rise

East Riding's Police Force Seek Newcomer

East Riding's Police Force Seek Newcomer

Unusual Bird Rescue in Scarborough

Unusual Bird Rescue in Scarborough

York & Scarborough NHS Trust Says Vote for NHS Heroes

York & Scarborough NHS Trust Says Vote for NHS Heroes

Difficult Start Continues For Scarborough Cricketers

Difficult Start Continues For Scarborough Cricketers

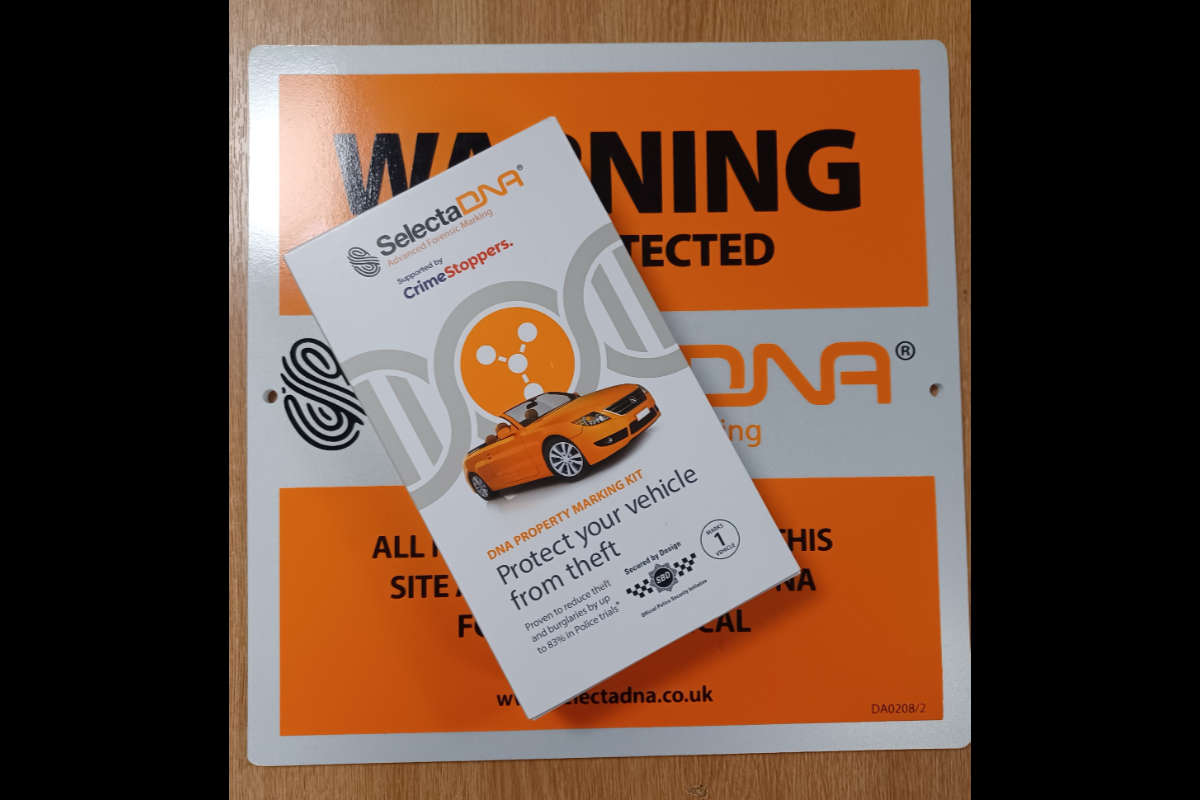

New Property Marking Kit Set To Protect North Yorkshire Farmers

New Property Marking Kit Set To Protect North Yorkshire Farmers

Labour Win North Yorkshire Mayoral Contest

Labour Win North Yorkshire Mayoral Contest

Tory Candidate Edges Home in Humberside Commissioner Race

Tory Candidate Edges Home in Humberside Commissioner Race

Comments

Add a comment