The number of people visiting Scarborough and Whitby increased in the first quarter of the year but so did the number of empty shops in Scarborough.

North Yorkshire's towns and attractions are generally performing well, with the latest data for Quarter 1 2025/26 indicating largely positive footfall figures across the region's town centres, despite some fluctuations. Attendance to local attractions is also holding steady.

Councillor Simon Myers, Executive Member for Culture, Arts and Housing, highlighted the intrinsic link between cultural offerings and economic vitality. Councillor Myers stated,

"The metrics show that where you have a thriving cultural sector and cultural venues then they do drive increased football in town centres and so on, and indeed it always forms part of the business case for investing in those facilities.

There seems to be a correlation between the two.

And the better our offer the more we develop our services in those terms, I think the better it is for those town centres and so on, both for ourselves and for the businesses that serve visitors."

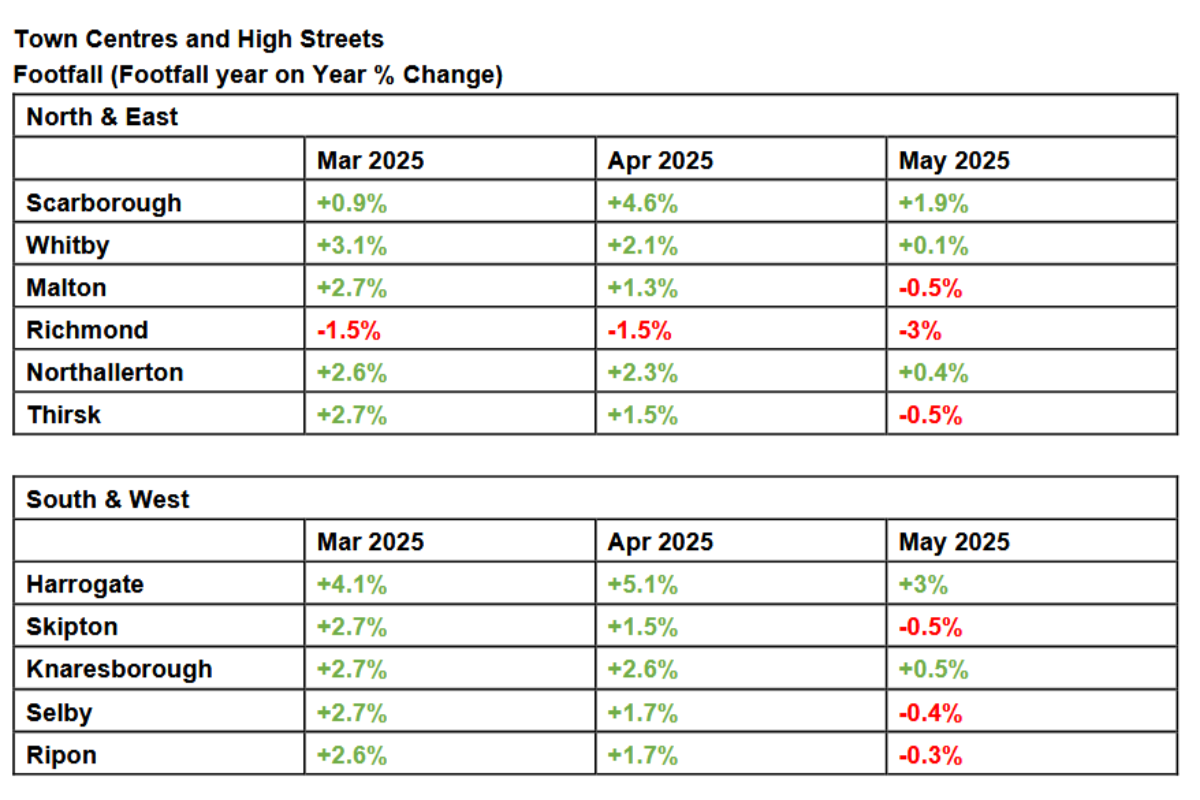

Town Centre Footfall: A Mixed Picture with Strong April Highlights

Overall, town centre footfall figures across the North Yorkshire region are largely positive. April saw notable increases in Scarborough and Harrogate, with Scarborough recording a +4.6% year-on-year change and Harrogate a +5.1% change. Whitby also experienced positive growth in April, with a +2.1% increase.

However, growth in May appeared slower, with some town centres experiencing reductions in footfall. The British Retail Consortium has suggested that this is a national issue, attributing the downward trend in town centres to the hot weather, which likely encouraged people to participate in other outdoor leisure pursuits. This trend, while impacting town centres, is believed to have a positive effect on other parts of the economy.

Councillor Myers says the the county's footfall figures are also encouraging despite a slight year on year dip.

"Footfall in our major market towns is holding up well. And in the same way, the visitor numbers to our cultural venues and attractions is holding up well. It is slightly down on the same quarter last year. That may be in part to do with the very warm weather.

That means people get different outdoor attractions."

For Scarborough, footfall was up by +0.9% in March, peaking at +4.6% in April, and maintaining a positive +1.9% in May. Whitby also showed a positive trend, with +3.1% in March, +2.1% in April, and a marginal +0.1% increase in May. Other towns like Northallerton (+0.4%), Harrogate (+3%), and Knaresborough (+0.5%) also maintained positive growth in May, while Malton, Thirsk, Skipton, Ripon, and Selby saw slight reductions during the month.

Cultural Venues and Tourism Performance

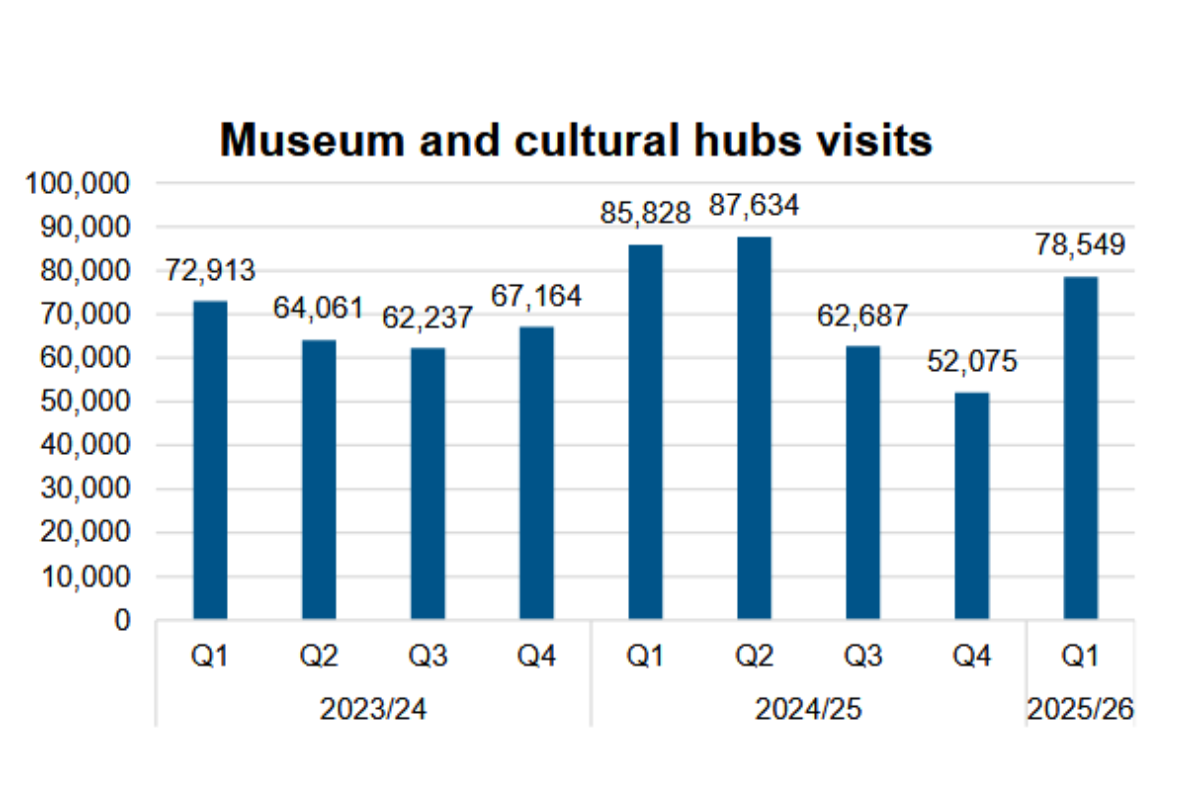

Visitor numbers to museums and cultural hubs have shown an upturn, indicating that the cultural offer remains strong. The digital offer for these venues also continues to grow, attracting over 9,000 users this quarter.

Despite this recovery from the previous quarter, the comparative performance across Q1 2025/26 for cultural venue visits is slightly down compared to the same period in 2024/25. The total number of museum and cultural hub visits for Q1 2025/26 was 78,549, a decrease from 85,828 in Q1 2024/25 but a significant increase from 52,075 in Q4 2024/25. This mirrors the British Retail Consortium's hypothesis regarding warm spring months encouraging outdoor activities.

Beyond footfall, the broader tourism sector also shows strength. Hotel occupancy in Q1 2025/26 reached 81.7%, an increase from 80% during the same period in 2024/25. Furthermore, revenue generated by each available room was up by 6.26%, rising from £70.23 to £74.92 in Q1 2025/26 compared to the previous year.

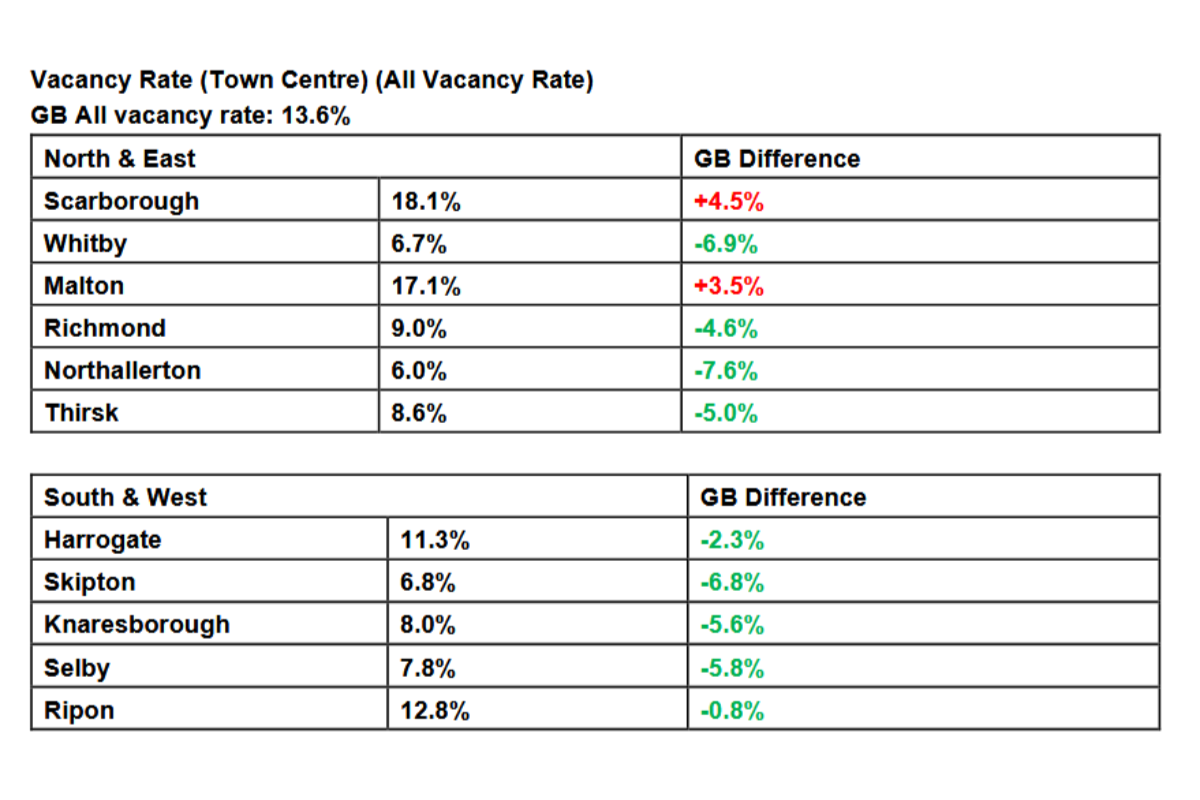

Vacancy Rates and High Street Health

Regarding town centre health, all towns in the region had a lower vacancy rate than the Great Britain average, with the exceptions of Scarborough and Malton. Scarborough's vacancy rate of 18.1% (4.5% higher than the GB average) is partially attributed to the Brunswick Centre being emptied for redevelopment. In Malton, where the vacancy rate stands at 17.1% (3.5% above the GB average), officers are undertaking a review of the data to understand any contextual factors influencing this figure. Whitby, in contrast, boasts a lower vacancy rate of 6.7%, significantly below the national average.

Both footfall and vacancy rate measures are considered vital for understanding the health of the high street and supporting wider economic development priorities.

Flood Warnings Issued For Scarborough's Sandside & Foreshore Road

Flood Warnings Issued For Scarborough's Sandside & Foreshore Road

East Riding Council Facing "Tough Decisions" as New Operating Model Signals Looming Redundancies

East Riding Council Facing "Tough Decisions" as New Operating Model Signals Looming Redundancies

Location for Scarborough's 400th Anniversary Sculpture Confirmed

Location for Scarborough's 400th Anniversary Sculpture Confirmed

New Chief Exec for Yorkshire Air Ambulance

New Chief Exec for Yorkshire Air Ambulance

Scarborough and Whitby MP Presses for Burniston Fracking Decision to be Delayed

Scarborough and Whitby MP Presses for Burniston Fracking Decision to be Delayed

Pickering and Filey MP Criticises Government for ‘Unfair’ Rural Funding Settlement

Pickering and Filey MP Criticises Government for ‘Unfair’ Rural Funding Settlement

East Riding to Introduce Weekly Food Waste Collections Amid Long-Term Funding Fears

East Riding to Introduce Weekly Food Waste Collections Amid Long-Term Funding Fears

Eastfield Boxing Club Film to Get Scarborough Premiere

Eastfield Boxing Club Film to Get Scarborough Premiere

Scarborough Athletic Stunned By Minnows in Senior Cup

Scarborough Athletic Stunned By Minnows in Senior Cup

Whitby Town Again Hit By Second Half Slaughter

Whitby Town Again Hit By Second Half Slaughter

Scarborough Café and Flat Plans Opposed by Town Councillors

Scarborough Café and Flat Plans Opposed by Town Councillors

Bridlington Town Beaten Again Despite Improved Showing

Bridlington Town Beaten Again Despite Improved Showing

Comments

Add a comment